Share this Post

Estimated Taxes

The United States operates on a pay-as-you-go tax system. This means you must pay taxes on the money you earn, as you earn it. There are two ways that taxpayers can pay as they go:

Withholdings

Generally, if you earn a salary or wage as a W-2 employee, then income, medicare, and social security taxes are withheld from your check and paid to the government on your behalf. Some taxpayers who earn money from multiple sources (i.e. self-employment income, interest, dividends, rental income, etc) may choose to increase their W-2 withholdings to cover the extra tax due.

Estimated Tax

If you own a small business, you will generally need to make estimated tax payments during the year. These payments must be made quarterly, with penalties imposed for underpayment or failure to pay. Taxpayers who earn multiple streams of income and who do not account for that with extra withholdings on their W-2, will also need to pay estimated tax. Estimated tax payments will be the main topic of discussion in this article.

Why You (Might) Need to Make Estimated Tax Payments

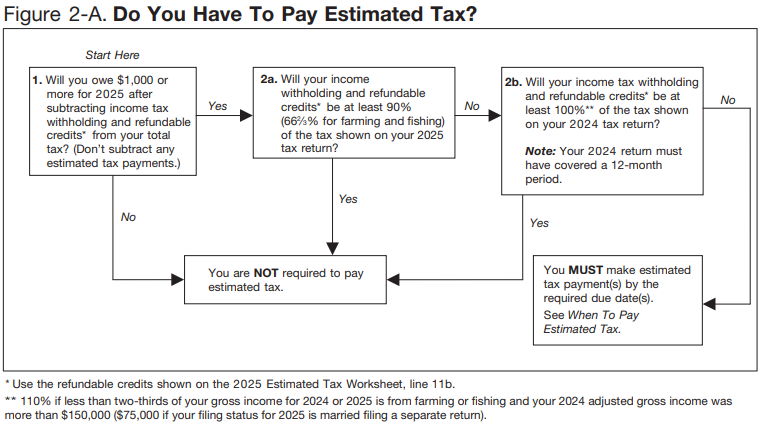

There are two general rules when determining whether or not you may be required to pay estimated taxes; both must be true for estimates to be necessary. The first states you expect to owe at least $1,000 after credits and other withholdings. The second is that you expect withholdings and credits to be less than the smaller of 90% of what you owed last year, or 100% of what you owe this year. IRS Publication 505 Figure 2-A provides a helpful guide:

Important 2025 Estimated Tax Deadlines

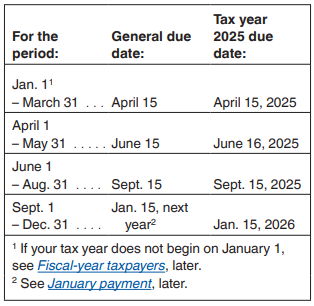

If you are in a position to pay estimated taxes, it is important to pay attention to the quarterly deadlines. If you do not earn income in the first quarter, you may wait until the first quarter you earn income to pay your estimate. The following are the dates of each quarter and their respective due dates from IRS Pub. 505:

How to Calculate Your Estimated Taxes

Every year, the IRS publishes a helpful guide, called the Estimated Tax Worksheet, that allows you to calculate the amount of estimated tax due. For this calculation, you will need your adjusted gross income, as well as any deductions and credits you may receive. To avoid the calculation, some choose to pay at least as much tax as was owed in the previous year. This option will avoid failure-to-pay penalties, but may result in a high tax bill at year-end if your financial situation has recently changed. Reach out to the team at Silver Accounting Service to ensure proper payment and avoid penalties!

Where to make payment

Paying online is the preferred method by the IRS, via their website at https://www.irs.gov/payments or by accessing your personal IRS account. You can pay online using a debit card, credit card, digital wallet, or ACH bank transfer. Payments by check or money order may be mailed with a voucher, provided on Form 1040-ES. The IRS advises to never mail cash payments, although cash payments may be accepted at specified retail locations.